Real estate investing stands out as one of the most potent avenues for achieving just that.

In this blog post, we’ll explore the world of real estate investing, shedding light on the concept of a Hybrid Real Estate Professional and why you should consider becoming one.

What is Real Estate Investing

Real estate investing involves the strategic acquisition, ownership, management, rental, flipping, or sale of properties with the primary objective of generating profit. This lucrative sector has consistently proven itself as a goldmine investment, meeting the fundamental human need for shelter while delivering substantial returns on investment.

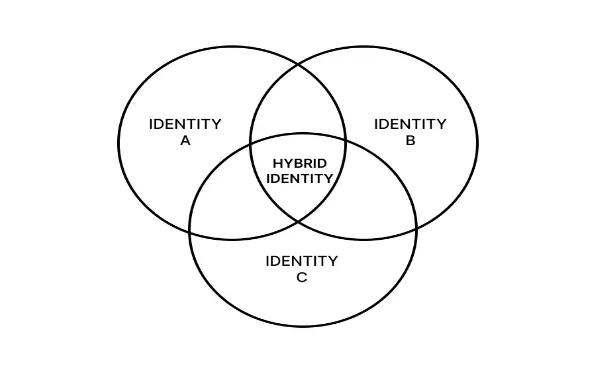

Understanding the Hybrid Professional Concept:

In the face of economic uncertainties and escalating living costs, the concept of a “Hybrid Professional” emerges.

This innovative approach as explained by Dr. Sarabeth Berk in her book “More Than My Title” involves integrating multiple professional identities to work at the intersection, effectively mitigating the risks associated with singular skill focus.

This concept resonated deeply with me as I grappled with my own professional identities. Everything felt fragmented and disconnected, until I realized that there were intersection points between all my different identities.

For a long time, I was afraid to publicly acknowledge my passion for real estate investing. But after reading Dr. Berk’s book, a new spin on her concept was born.

The Hybrid Real Estate Professional.

The Hybrid Real Estate Professional seamlessly incorporates real estate investing into their skillset & income streams, all without disrupting their existing professions, businesses, or family life.

Benefits of Becoming a Hybrid Real Estate Professional:

1. Diversified Income: Real estate investments provide an additional income source, enabling professionals and business owners to diversify revenue streams beyond their primary source. The Urban Land Institute’s (ULI) report states that diversifying into real estate can enhance overall portfolio performance and resilience.

2. Tax Advantages: Enjoy various tax benefits, including deductions on mortgage interest, property depreciation, and operational expenses, resulting in significant tax savings. According to the Tax Foundation, real estate is one of the most tax-favored investment classes.

The most common scenario when owning rental properties is to have a “paper” loss on your taxes due to depreciation & other tax benefits, while having a positive “real” net income.

As a bonus, those “paper” losses can offset capital gains from other investment income such as the sale of stocks, bonds, or other securities.

3. Inflation Shield: Real estate has a long-standing track record as a reliable shield against inflation, effectively preserving purchasing power over time as property values ascend. Notably, data from the Yahoo Finance home value trend reveals a robust trajectory.

Over the past two decades, the average home price in the U.S. has surged from around $140,000 to approximately $340,000 as of April 2023, marking an impressive over 40% increase during this period. This underscores the resilience of real estate as an asset class capable of outpacing the erosive effects of inflation, making it a compelling choice for long-term wealth preservation.

Another inflation-related benefit rental income tends to rise with inflation, while your fixed-rate mortgage payment stays the same. As you continue to make fixed payments in an inflationary environment, buying power effectively increases over time as the real value of your debt diminishes.

4. Long-Term Wealth Building: Real estate stands as a stable and appreciating asset, presenting a strategic, long-term approach to building wealth for lasting financial security. Insights from the Federal Reserve’s Survey of Consumer Finances underscore this, highlighting that the net worth of homeowners significantly surpasses that of renters.

The benefits of real estate investing often are felt later in the loan period. Your principal payment accelerates as your loan is paid down and your cash flow increases over time as rental rates rise. The long-term compounding effects of rental real estate are unrivaled, especially over a decades-long time-horizon.

How to Become a Hybrid Real Estate Professional:

1. Educate Yourself: Start by immersing yourself in real estate investing education, including books, seminars, and online courses, particularly those led by a real estate investing coach, that provide structured learning opportunities targeted toward your goals.

2. Get a Coach: Consider hiring a real estate investing coach for personalized guidance, accountability, and support, accelerating your learning curve, and avoiding costly mistakes.

Yes, the information is available online. But finding a mentor who has done what you want to be doing that can help you with YOUR specific situation is worth the investment.

3. Develop Your Plan: Create a detailed investment plan outlining target market, property criteria, financing, and exit strategies with the assistance of your coach. Work backwards from the outcomes you’re trying to achieve (EXAMPLES: time freedom, wealth accumulation, lower-pressure lifestyle) and craft your ideal strategy. This will enable the confidence to buy properties that support your goals, and the skills to tune out all the rest.

4. Start Small, Scale Up: Begin with smaller investments to gain experience and confidence. Gradually scale up as you become more comfortable, receiving guidance and support from your coach at every stage.

In a world where “hyper-scaling” or going from “0 to 100 units in 2 years” is glorified, you must develop the discipline to pave your own path. For most people, this means starting small & scaling a pace that feels right.

Remember, a Hybrid Real Estate Professional often has other priorities such as a job, family, or outside interests to balance in with real estate investing. That means the lifestyle design is a crucial component of your strategy.

Conclusion:

Becoming a Hybrid Real Estate Professional isn’t just a financial decision; it’s a strategic move towards securing your financial future. By seamlessly integrating real estate investing into your professional life, you not only diversify your income but also open doors to a world of financial opportunities.

Ready to take the leap? Embark on this transformative journey with a real estate investing coach and watch as your financial success unfolds.